schedule c tax form llc

TNT Ventures LLC is a limited liability company LLC located at 15 Corporate Pl S Ste 4 15 Corporate Place South Ste 4 in Piscataway New Jersey that received a. The Schedule C is an IRS form that collects data about your small business and then calculates your net profit.

How To Report Cryptocurrency On Your Taxes In 5 Steps Coinledger

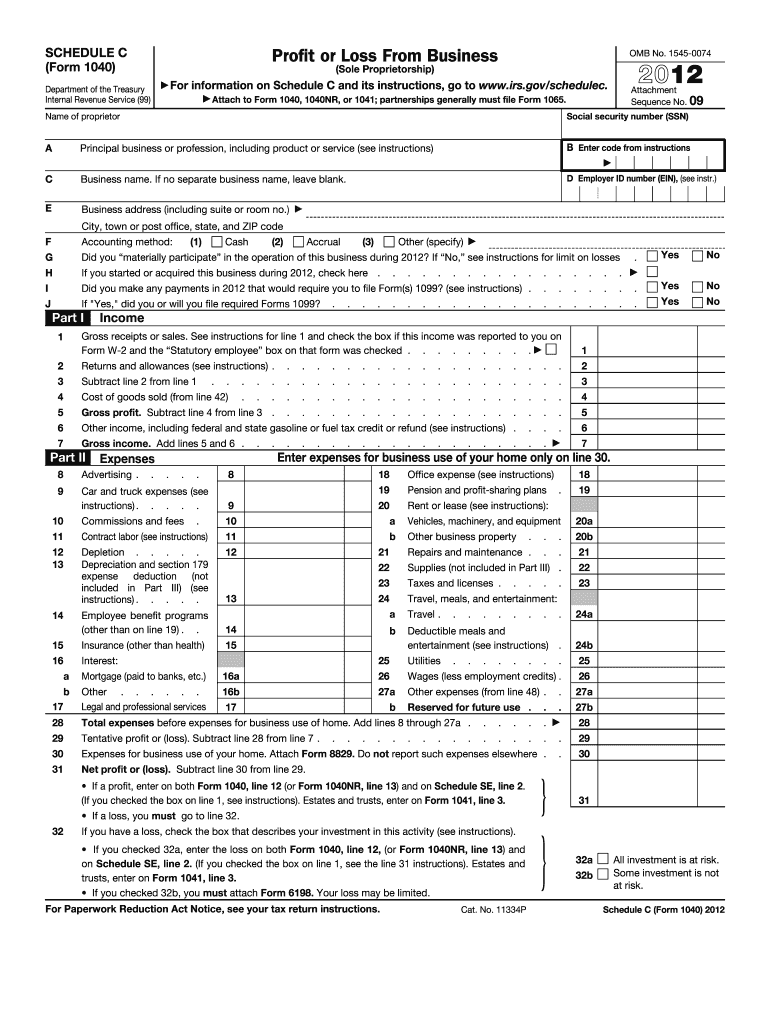

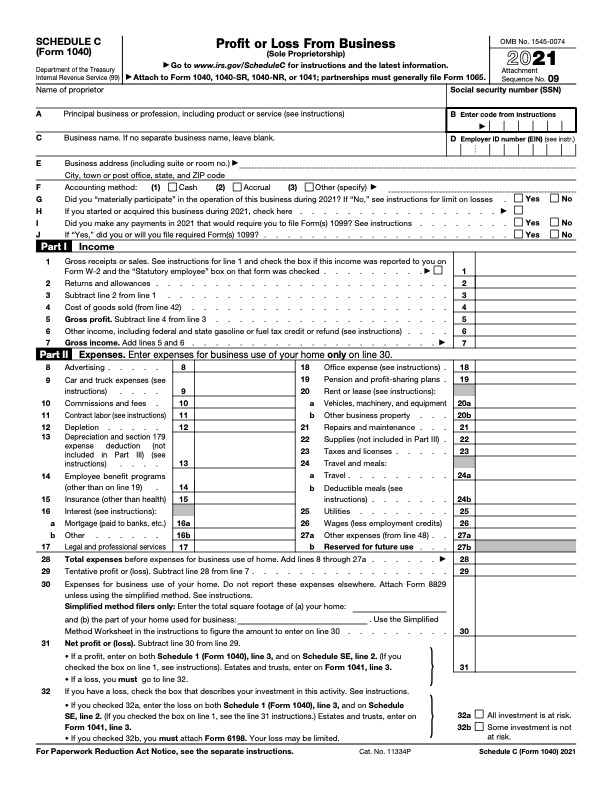

It is a form that sole proprietors single owners of businesses must fill out in the United States when.

. If you run your own. 871 a and 881 a impose a tax of 30 of the fixed and determinable annual or periodical FDAP income received from sources within the United. In 2010 Company X purchased 100 of Company Y an LLC legally and commercially domiciled in New Jersey with.

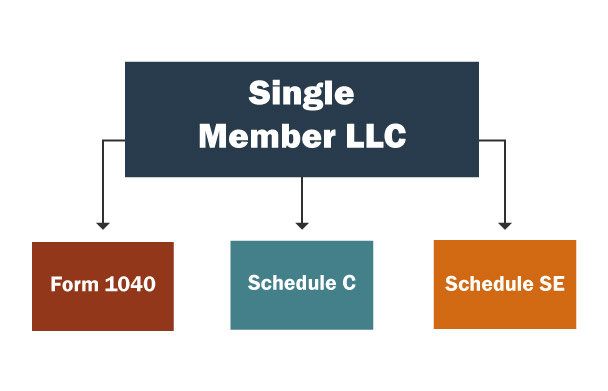

Schedule C is for two types of business - a sole proprietor or a single-member LLC that hasnt elected to be taxed as a corporation. Contains all the tools features that smart tax professionals want appreciate. Schedule C Form 1040 is a form attached to your personal tax return that you.

Sole proprietors must also use a Schedule C when filing taxes. Individual A a New Jersey resident owns 20 of Company X. New York City.

The Schedule C tax form is not for. Converting your S corporation to an LLC takes careful planning and a detailed knowledge of both business entity law and the Tax Code. For advice and counsel that can reliably help you.

An LLC Schedule C should be used by a single-member LLC when filing business taxes as a sole proprietor. Professional tax software for CPAs accountants and tax professionals. The Schedule C tax form is used to report profit or loss from a business.

A single-member LLC is a business entity owned by just one person. Per IRS Instructions for Form 1120. The profit is the amount of money you made after covering all.

Schedule C is a tax form for small business owners who are sole proprietors or single-member LLC owners. There is generally no distinction between the business owner and the LLC for income tax purposes. You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040.

Schedule C is typically for people who operate sole proprietorships or single-member.

What Tax Form Does An Llc File

Schedule C Pdf Fill Online Printable Fillable Blank Pdffiller

Irs Schedule C 1040 Form Pdffiller

How To File Schedule C Form 1040 Bench Accounting

The Choice Is Yours 3 Ways For Llcs To File Federal Income Tax Xendoo

Additional Schedule C Wilson Financial Wealth Management And Financial Planning

What Is Irs Form 1040 Overview And Instructions Bench Accounting

How To Fill Out A Schedule C For A Sole Proprietor Or Single Member Llc

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

What Is Schedule C Who Can File And How To File For Taxes

How To Fill Out Schedule C Stripe Help Support

How To Fill Out Your 2021 Schedule C With Example

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

Schedule C Form 1040 Sole Proprietor Independent Contractor Llc How To Fill Out Form Schedule C Youtube

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

How To Single Member Llc Sole Proprietor Taxes Dp

What Is A Schedule C Tax Form Legalzoom

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax